Advance Child Tax Credit The expanded and newly-advanceable Child Tax Credit was authorized by the American Rescue Plan Act. The IRS will calculate these payments based on the 2020 tax return. If that return is not available because it has not...

Read MoreTax Breaks for a Dependent Parent

Eventually, some adults find themselves providing financial support to the people who previously supported them as children (their parents). If you pay over half the costs of supporting your parent, you may be eligible for some well-deserved tax...

Read MoreThe Evolution of the Employee Retention Credit

The Evolution of the Employee Retention Credit The pandemic has adversely affected many sectors of the U.S. economy, causing widespread job losses. At the start of the national emergency, Congress created a novel tax break — the Employee...

Read MoreTemporary Changes to the Child and Dependent Care Credit

The American Rescue Plan Act (ARPA) includes major, but temporary, changes to the longstanding federal income tax child and dependent care credit. The changes are favorable for most taxpayers, except high-income individuals. Here’s what you...

Read MoreCOBRA Subsidy

One of the many provisions signed into law with the American Rescue Plan Act of 2021 was a new COBRA premium subsidy that pays for 100% of the applicable premiums for eligible individuals. To comply with the law, businesses will face a few...

Read MoreChanges to the 2021 Child Tax Credit

The American Rescue Plan Act (ARPA) significantly liberalizes the rules for the federal child tax credit, which means more money in the pockets of eligible parents this year. However, the liberalizations are only for the 2021 tax year. Pre-ARPA...

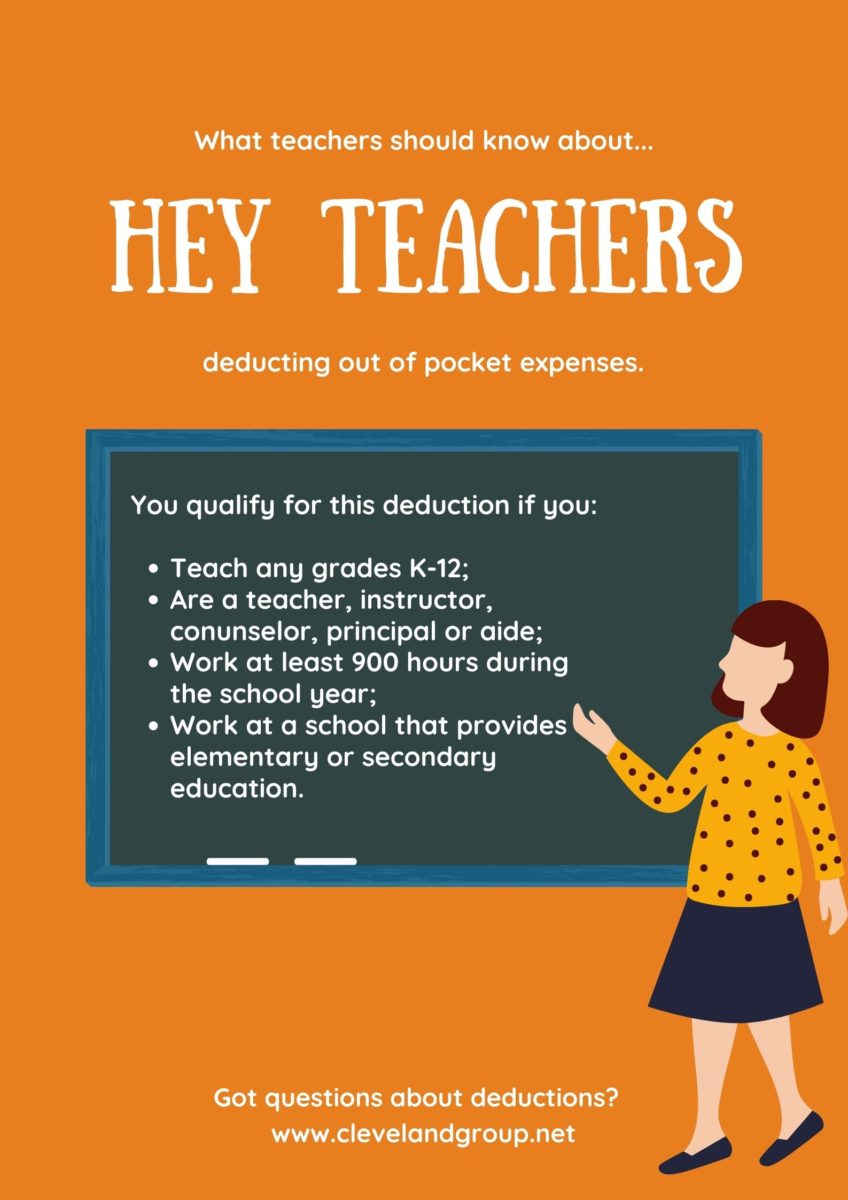

Read MoreTeachers – What you need to know about deducting out of pocket expenses for your classroom.

Now that fall is here and school has started, many teachers are dipping into their own pockets to buy classroom supplies. Doing this throughout the year can add up fast. Fortunately, eligible educators may be able to defray qualified expenses...

Read MoreEconomic Impact Payment – What You Really Want to Know.

What you really want to know about Economic Impact Payments Is this payment considered taxable income? No, the payment is not income and taxpayers will not owe tax on it. The payment will not reduce a taxpayer’s refund or increase...

Read MoreGiving Tuesday

The Coronavirus Aid, Relief, and Economic Security (CARES) Act includes several changes that encourage charitable giving during the coronavirus (COVID-19) crisis. This is welcome news for certain public charities, including churches, educational...

Read MoreReturn to Work Safety & Guidance

Some essential businesses have remained open during the COVID-19 pandemic and adjusted quickly to protect the well-being of their employees. However, others are just preparing to reopen as soon as state and local officials lift restrictions. ...

Read MorePreparing for Post COVID Business Changes

Few businesses have been left unscathed by the novel coronavirus (COVID-19) pandemic. Unfortunately, many have been mortally wounded. Some may be living on life support thanks to financial help from the government, but their long-term survival is...

Read MoreWhere’s My Economic Impact Payment?

Millions of Americans have already received their Economic Impact Payments. The IRS continues to calculate and automatically send the payments. However, some may have to provide additional information to the IRS to get their Payments. Please...

Read More